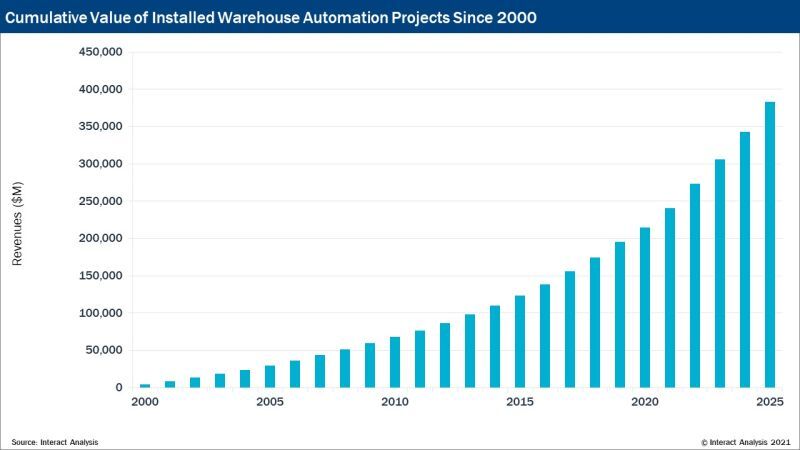

In a new report on the warehouse automation service market, research company Interact Analysis has revealed that soaring growth in the warehouse automation equipment market is causing parallel growth in the market for service contracts – worth $4.3bn in 2020 and projected to grow to $8.7bn by 2025.

Interact Analysis’s research predicts that the global market for servicing of installed automation equipment will see year-on-year double-digit growth up to 2025, when revenues will top $8.7bn. This will be a stable and lucrative market for OEMs and integrators, affording higher profit margins than equipment sales. Currently, a significant number of end-users carry out service and maintenance in-house or use a third party. And there are also customers who consider it cost-effective to leave their machinery un-serviced. Interact Analysis’s work shows that the growing complexity of equipment and rising pressure to avoid machinery down-time, will mean that OEMs and integrators will significantly grow their share of the services market in the next five years.

In 2020, on-site service in various incarnations – site visits to identify and repair problems, preventive maintenance visits, and the deployment by OEMs of technicians to sites on a full- or part-time basis – accounted for 40% of service revenues. Upgrade services (modernization or alteration of existing systems, not replacement) accounted for 22%, and remote services, where customers have telephone hotline access to support, 19%. That figure of 19% belies the fact that basic hotline service packages have a very high take-up among end-users, some 80-90%. Additionally, on-site services will become more prevalent as automation solutions get more sophisticated.

Jason dePreaux, principal analyst at Interact Analysis says: “In 2020, 80% of the revenues from automation machinery service contracts were generated in the Americas and in the EMEA (Europe, the Middle East, and Africa) region. Historically, there has always been a much higher adoption rate of service arrangements in those two regions than there has been in the Asia Pacific (APAC) region – due to lower labour costs in Asia, expectations for maintenance to be included in the project sale, and robust in-house service capabilities by large eCommerce companies. But this situation is set to change. As worker expectations rise and wages level up in APAC, and other factors come into play, such as recent experiences with social distancing and the pandemic, we expect the region to be setting the pace where warehouse automation installations are concerned. Indeed we forecast that, by 2024, the rate of growth in the APAC service market will be faster than in the Americas or EMEA.”